14Nov1:12 pmEST

You Want it to Be One Way

Luck, by definition, is streaky. The streaks, even outliers, at times can seem like the norm. But just as in most forms of gambling it is the very acceptance of the new paradigm which actually leads most speculators to ruin when the smoke-and-mirrors is lifted and markets change again, as they inevitably do.

If you play enough poker, for example, you will see drunk, loose, and overly-aggressive players winning obscene amounts of money in very short periods of time, creating the illusion that their strategy is sound. And then they will come back to the casino the next night and do the same thing again, steamrolling a table for most of their chips. And then again, for a good while even. Eventually, though, one night the math reverts and the tide goes out, with no underlying discipline to cushion their fall.

And then they disappear for good.

One of the longest streaks I have ever seen, personally, was by an overly-loose/aggressive regular at the Borgata poker room last decade, towards the end of the poker bubble, in the 40/80 Limit Texas Hold 'em game down in Atlantic City. He was "on the heater," running over games and catching mathematically improbable cards for months on end, which ultimately stretched out for over a year. It is estimated that he won over $1 million in that game alone, over the course of a year. Simply put, he was on an extended lucky streak, with the fact that he played too many mediocre starting hards (the two down cards players are dealt in Hold 'em before the community cards are shown) exacerbating the odds of a winning streak for that duration.

It all ended within a matter of weeks.

He started playing even higher stakes games, ran cold, went on emotional tilt (already the mercurial type) throwing his cards at the dealer and other players when he lost a big hand, and blew through a few hundred thousand in the blackjack pits in an attempt to "chase it back" and summons the glory days of his extended, hot winning streak. But the streak was over. He wound up asking me and many other players for money to put him back in the 40/80 game. Eventually, he got kicked out of his house by wife and had not been seen at any poker room in years.

These types of instances seem unfathomable to many who think speculation is easy/fun/glamorous, or who read a book and think the concepts are basic enough. But there is a reason why a premium is placed on mere survival in this business as a speculator, especially when trading your own money and not taking commissions off someone else's.

And that reason is because not only can anything happen for short periods of times in markets and in speculation at-large, but it does happen, and oftentimes it does happen for long periods of time.

Time and time again, market history is littered with instances where all forms of analysis were deemed obsolete and no longer worthy of being utilized. In the current landscape, technical analysis has come under fire with the constant "V-Shaped" recoveries by equities against a backdrop of easy global monetary policies in developed economies.

But it is worth remembering how fundamentalists and value investors were castigated in late-2008 and especially in 2009, which we now know in hindsight was foolish, as that time period was precisely when value investors would have been swooping in for great deals. Simply put, the more things change in markets the more they stay the same. The cycle of "kissing up" while "kicking down" to a given paradigm is a natural part of the greed/fear pattern of human emotions.

Just last night, for example, a well-to-do asset manager guaranteed me (without being prompted by me and without knowing about my involvement in markets) that the S&P 500 would hit 2300 within the next several months, and that the rate on the 10-year was bound to plunge back below 2%. And also volunteered to me that technical analysis was now completely irrelevant due to the monetary policy, HFT, and a few other factors.

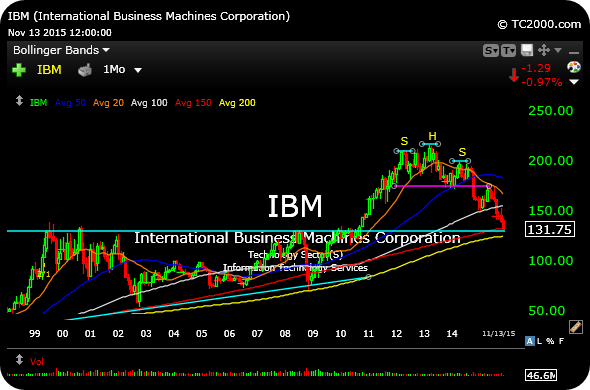

But, beyond the anecdotal, the notion that sound technical analysis "no longer works" will always be part of markets, which enables the likes of IBM, updated below on the monthly timeframe, to achieve a long-term head and shoulders top downside target this website has noted for several quarters now.

Going forward, I suspect that sound, old-school technical analysis, now that it has been thoroughly dismantled by many as being antiquated in a new age of robots and derivatives gunslingers, will quietly continue as an excellent risk management tool, offering effective ways to define quality, actionable trade setups and preserve capital while increasing long-term survival in what will always be a business where just when most want it to be one way, it turns out to be other other.

A Five-Minute Clip Explainin... Stock Market Recap 04/16/18 ...