16Nov10:32 amEST

A Double Whammy

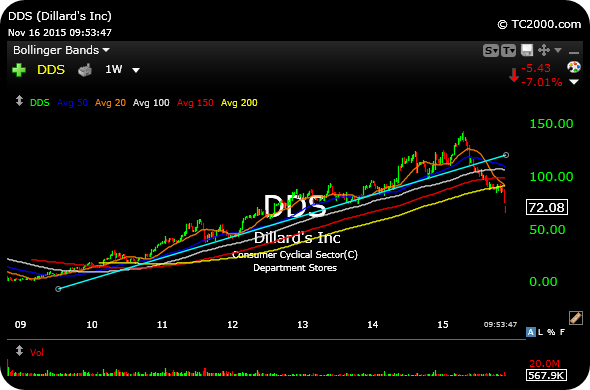

If rates do keep going higher, it would likely only add credence to the idea that retail plays with REIT exposure, such as Dillard's, have broken trend for a meaningful period of time. One of our Members pointed out the DDS shellacking earlier this morning, magnifying the continued weakness in many consumer-related areas.

But the REIT component may certainly add fuel to any further moves lower, after a likely oversold bounce for DDS and a few other rotten retails which are badly oversold at the moment, including URBN.

On the weekly DDS chart, below, note the broken steep trend, as many other retailers have similar charts.

Elsewhere, the MAR and HOT merger looks to be shrugged off by the market initially, in terms of those stocks' moves. And CLVS is the latest biotech blow-up, down nearly 70%.

Stocks, as a whole, are bouncing back a bit this morning despite weakness in small caps, financials, and crude oil. We have our eye on a few fresh trade setups, after scaling gains on the short side Friday and this morning, but will see how this market bounce attempt unfolds into midday.