17Nov3:11 pmEST

Playing Field Position

Watching the Houston Texans upset the previously-undefeated Cincinnati Bengals last night in a defensive battle, I was reminded of the antiquated notion of "playing field position." As the NFL rules have increasingly favored offenses, while protecting golden goose quarterbacks in recent years, low-scoring defensive battles have become scarce. But we saw one last night, with the Bengals only putting six points on the board and failing to get into the end zone, while Houston won scoring only ten points.

In a "field position game," the defenses are so stout that both offensive units begin to favor merely advancing the ball to midfield before punting on fourth down and trying to pin the opponent's offense deep in their own territory, the epitome of a defensive battle.

Applied to the current market, the defense by bulls and bears alike in recent quarters has been so stout in terms of permitting sustained breakouts higher or lower, with the S&P 500 trading essentially right where it was one year ago today, that most attempts to put big points on the board, or score huge winning trade, carry the additional risk of going up against that great defense.

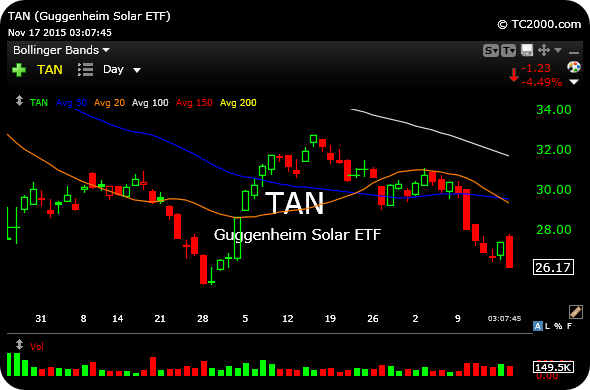

Solar, for example, a bastion of home runs in 2013 for high beta, momentum traders at times, has completely fallen apart, with the SUNE blow-up not helping the cause. Even yesterday's bounce looked promising for a reprieve.

But on the updated daily chart for the sector ETF, below, you can see how tightening up and playing field position, meaning waiting for upside confirmation to hold of any meaningful reversal, would have prevented falling victim to today's vicious bearish engulfing candle lower.

Playing field position may not be as exciting or fun as a high scoring affair, but in this market climate it sure does help minimize unnecessary errors.

Stock Market Recap 12/17/18 ... Dove or Hawk? How About a Ch...