18Nov10:30 amEST

Inside the High Beta Elevator Down

GoPro has, perhaps, accounted for more retail traders' losses among the high beta momentum names over the last full year than any other stock in the market. Not long ago, we looked at the GPRO chart and surmised that once the IPO lows were breached, we were operating in an area with no prior price memory and therefore there was no telling how low the stock could go.

Updating the daily chart, first below, that swoon continues today into the unknown sea of losses for trapped longs holding from above. Nonetheless, a huge down day like this morning's 9%-plus move lower may be bringing us closer to some type of cathartic low, particularly with another gap down or two this week.

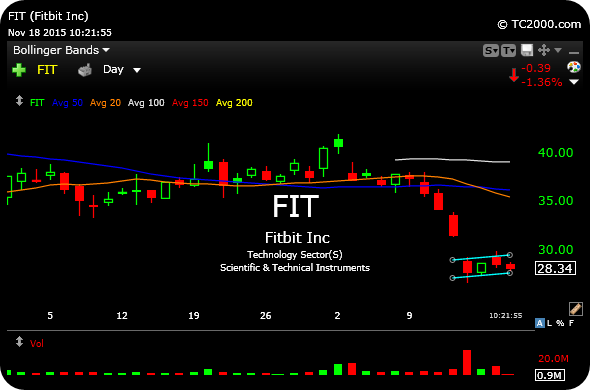

With this in mind, FitBit is another busted high beta momentum fad IPO. Along the lines of GPRO, FIT has wreaked havoc since an initial head-fake after coming public. On the second daily chart, below, I suspect another move below $28 would see a GPRO-esque plunge.

So while GPRO may be getting closer to its washout low (even if only a minor reprieve), FIT may have some unfinished business below.

The elevator down for high beta momentum names can be vicious, beyond that drama surrounding a firm like VRX. Furthermore, in the case of DGLY HABT MBLY SHAK, even if they do stop going down, the charts need time to heal and may very well prove to be anything but action for the foreseeable future to the dismay of a great many action-seeking traders.

Stock Market Recap 11/17/15 ... Strolling in for the Main Ev...