10Dec12:46 pmEST

I Reckon I'd Be Much Obliged if Crude Oil Reacted to These Divergences, Ma'am

It is another day, and it is also another weak session for crude oil.

Headed into the FOMC decision next week, the lingering issue remains whether Black Gold needs a further cathartic washout of bottom-fishing longs in order to arrive at a more tradable low.

On the one hand, energy stocks in the OIL XLE have held comfortably above their late-August lows, for the most part, despite fresh lows in the HYG JNK (high yield and junk bond ETFs, respectively).

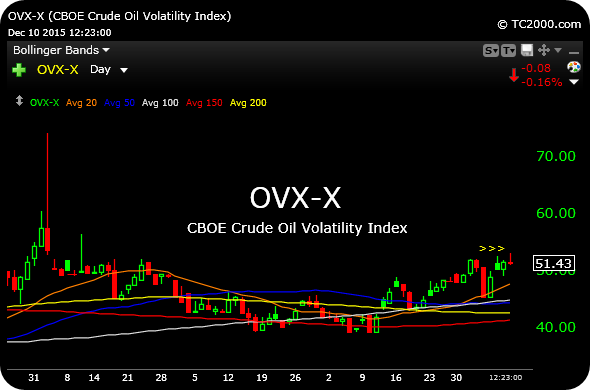

Moreover, as a Member astutely pointed out to me earlier, the crude oil VIX (or OVX-X), is actually flipping red as I write this, meaning fear in the crude market has abated, for now.

Of course, the bear interpretation of this is that complacency lingers, and trapped longs need to capitulate.

For now, both natural gas and crude oil are hands-off for me. I am, however, interested to see if gold miners can continue to show resilience of their own above recent lows. Frankly, as weak as the metals and miners have been at times in recent years they should have probably been swooning along with crude of late.

Looking for That Certain Spa... Final Hour Handle Out of Whi...