23Dec10:41 amEST

One False Move or More

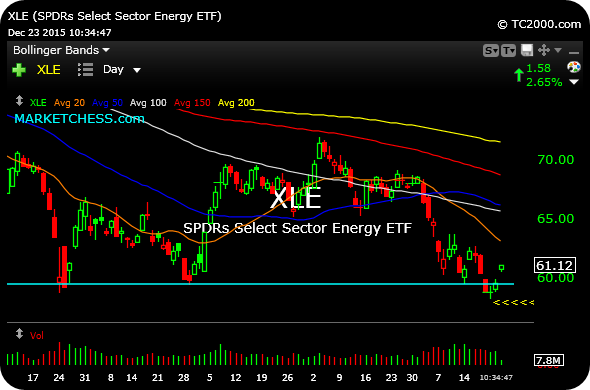

On Stocktwits yesterday and on the private Twitter feed for Members we looked at a potential false breakdown, or "bear trap," in the XLE, energy sector ETF. For quite a while now, we have been interpreting the XLE chart as decisively bearish, resisting the urge to declare a major inflection point at hand to what has been, in effect, an energy bear market.

Still, when you see price breach a series of well-defined lows and then reverse sharply higher, as we have seen the XLE this week, it does raise the specter of at least a temporary low in place. Coupled with the strong action in crude oil itself today, energy bears should likely back off their shorts until 2016.

On the other side of the false-move spectrum, NKE is now in the red despite hitting new all-time highs after earnings last night. This is, still, an abnormally-steep long-term uptrend which has the look and feel of a chart which has already priced in the abundance of what is now widely-know good news for the firm.

Stock Market Recap 12/22/15 ... Kiss Everyone Without Fangs ...