24Dec9:58 amEST

Waiting to Take Shape

As we wind down this Christmas-shortened week of trading today with the 1pm EST early close, markets are still punishing traders trying to force in a given thesis to what has been a decidedly amorphous tape for quite some time. The S&P 500, for example, is trading roughly 20 handles lower than it was last Christmas Eve, while we know the FANG stocks in the QQQ are much higher. But, then again, the small caps in the Russell and NYSE Composite Index are much lower than they were last year at this time.

We have maintained our tactical, defense-first mindset inside Market Chess Subscription Services this year, with VIP Members picking off a long-term buyout in DMND while collecting a dividend from an outperforming under-the-radar tobacco play.

But beyond that, we have emphasized religiously cutting small losses, carefully taking on new trades, and not buying into the given emotion of the moment as is the norm these days in a fast-paced social media atmosphere. Of course, we stay on top of outperforming stocks, like PACB.

However, surviving these types of markets with capital and confidence intact is a lesson learned inevitably--Either through the "easy" way of real-time discipline, or the hard way of riding an emotional roller coaster, hubris, allowing ego to overtake the message of the market, and failing to acknowledge losses in a timely manner.

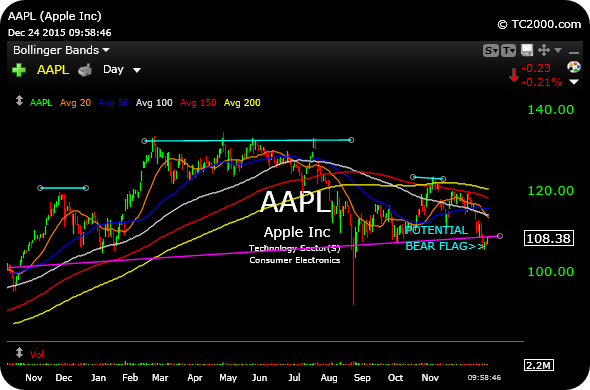

AAPL may very well be a symbolic test for this market, in light of the bounce this week. On the daily chart below, the multi-day bounce looks to be a bear flag consolidation (meaning a simple setup to resolve lower and continue the downtrend). AAPL is a name we shorted previously, and into weakness next week and beyond I have my eye on another entry.

Kiss Everyone Without Fangs ... Saturday Night at Market Che...