07Jan10:43 amEST

A Plot Twist for the Loonie

To follow-up on a blog post from yesterday, the petro-currency, Canadian Dollar or "Loonie," continues to merit attention as crude oil searching for some type of tradable low. I have doubts as to anything remotely close to a major, durable low in crude until we see massive global supply cuts.

However, crude may be close to keeping shorts honest, if only for a few days.

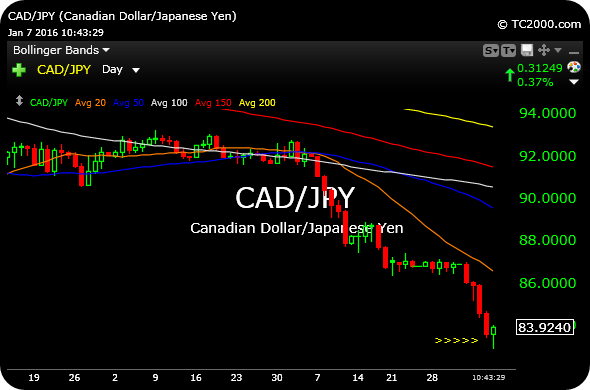

In determining whether or not that thesis materializes, the Loonie would likely need to follow-through higher on the daily chart reversal "hammer" candlestick it is currently printing against a risk-off currency like the Japanese Yen, seen below.

Note how this hammer is printing after a prior, steep, and established downtrend, meeting the elements of the definition for a hammer. If the Loonie bounces, so too should Black Gold.