15Jan10:19 amEST

Mirror Image Markets

In corrective or bear markets, it is often said that correlations run even more tightly than usual, in terms of inter-market analysis. Specifically, "risk off" currencies like the Japanese Yen tend to come to he forefront, as do credit markets, as opposed to healthy bull runs in equities where those correlation tend to take a backseat to the "Res Ipsa Loquitur" strength in stocks.

Moreover, the tight correlations are also a function of overall confusion, indecision, and distress in markets are no one knows, for sure, just how bad things truly or, or instead if markets are overreacting and thus creating terrific buying opportunities. As a result, we see the tight and highly sensitive correlations.

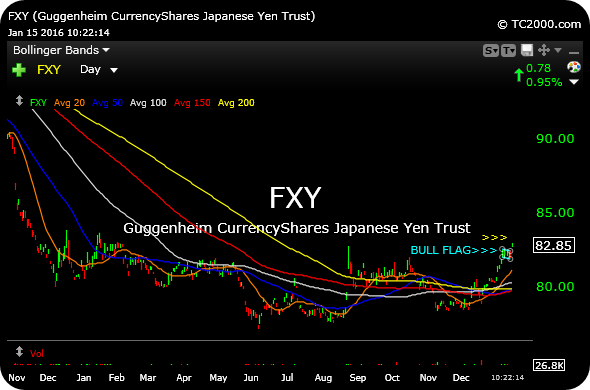

As an example, we can see the Yen, below, on the daily chart for the ETF. After trying for a massive base bottom over the last year after a prior downtrend (while equities had enjoyed a multi-year bull run an subsequent potential massive top, during the same time), the risk-off Yen is now breaking a high and tight bull flag consolidation to the upside today.

If the Yen is just now emerging from a massive bottom, equity bulls will likely need to overcome this inverse correlation with even more buying power, something which has been clearly lacking in 2016 so far.