21Jan10:45 amEST

We're All a Little Loonie Watching Oil

In front of a belated crude oil inventory report, at 11am EST this morning, stocks are enjoying a decent bounce. Crude is up a bit, via the USO ETF, too.

But, perhaps of just as much significance, the Canadian Dollar, or "Loonie," is finally showing signs of life for at least a relief rally after a powerful downtrend. As we have noted before, the Loonie is widely seen as a "petro-currency," meaning its price movements often have a tight correlations to the action in crude oil, itself.

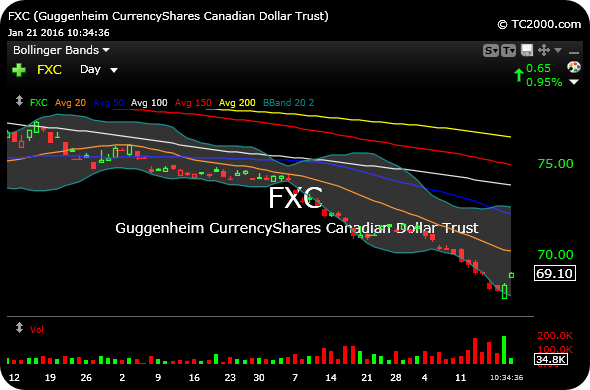

On the FXC daily chart, below, which is the ETF for the Loonie, now the gap up in front of inventory. This type of action may be telegraphing the long-awaited counter-trend rally in crude.

In addition, if the energy complex rallies, a leveraged long ETF lie GASL is worth watching for quick long trades, which trades with more volume than a similar one like GUSH.