22Jan12:57 pmEST

Let's Fix This Problem

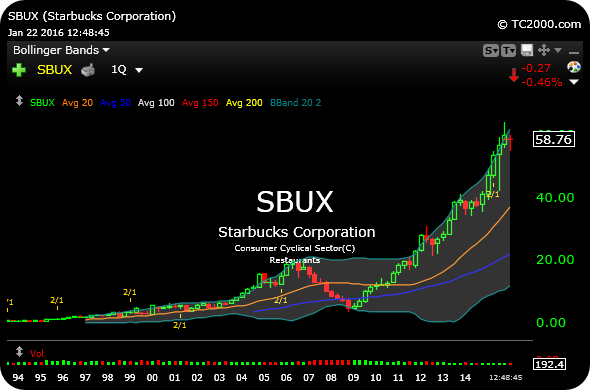

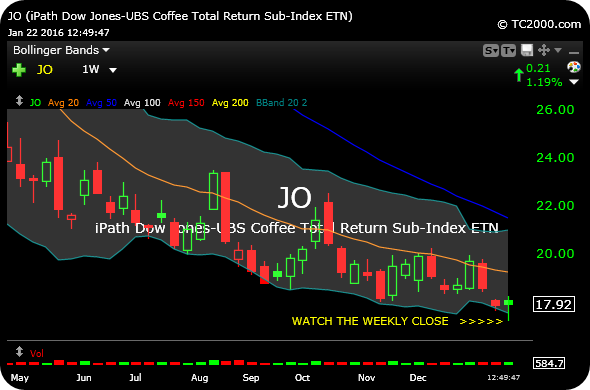

With earnings now out of the way for Starbucks, one lingering issue is the huge spread between the endless multi-year uptrend for SBUX versus the perennial heartbreaker of JO, the coffee ETN. While it is true that Starbucks is not necessarily intimately tied to the price of coffee, or perhaps anything close to it, there could no doubt be an excuse (not a catalyst) in there somewhere with a coffee rally for SBUX to finally come in.

The quarterly SBUX chart, first below, shows an abnormally-steep uptrend which should unwind this year, especially if the 2016 lows in the broad market are either retested or breached later this winter.

On the second chart, below, the weekly JO shows a potential reversal candlestick after coffee has rallied back hard from a gap down on Wednesday.

Regardless of the underlying analysis, the reality is that there is a huge spread between coffee and SBUX, which may be symbolic of commodities and the consumer at-large. And given their respective chart structures, I expect that spread to narrow this year and the many bifurcations across global markets come home to roost.

c

Probing a Coffee Long; Chess... While the Dollar Lounges Aro...