08Feb10:59 amEST

Bursting the Dam of Support

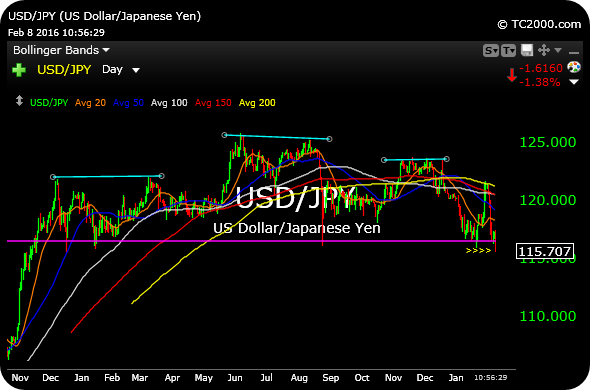

Equities continue to get pounded this morning, and it is likely no coincidence that the Dollar/Yen currency cross is also losing a major price area, too.

As the Dollar/Yen chart, seen below on the daily timeframe, moves lower, the Yen moves higher. A higher Yen is not what the Bank of Japan had in mind a few weeks ago when it moved to NIRP (negative interest rate policy).

And, yet, the technicals took control--The declining 200-day moving average inflicted its power over traders who assumed the market was "trading on news," or trading on Central Bankers, or fundamentals for that matter.

In fact, the technicals would have saved you a ton of heartache insofar as not assuming anything remotely close to a durable low was at hand, given the swift rejection by the currency cross at the 200-day, leading to a move to multi-quarter lows.

As it stands now, if buyers cannot prevent the breakdown from the outlined head and shoulders top via a last-minute stick save, it is likely stocks still have more unfinished business to the downside in what is proving to be a powerful downtrend with sentiment still apparently aloof and lacking in fear.