12Feb12:51 pmEST

Big Hammers and Big Volume

Although today may largely prove to be a fairly low volume bounce in the market, the story this week could easily be the heavy volume we have seen in the likes of crude oil, gold and precious metals miners, and headliner Deutsche Bank.

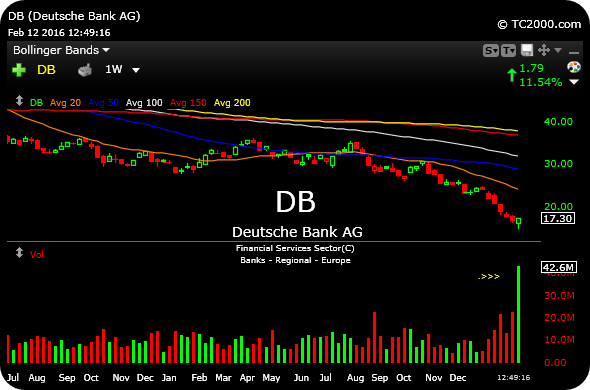

As an example, consider the DB weekly chart, below, and massive volume this week as the stock reverses sharply higher today.

There are a few considerations here, since assuming a slam-dunk bottom already in place carries far greater risks than many would presume. First and foremost, even if these high volume tickers in question have, if fact, bottomed, there is a big difference between a momentum low (a seminal moment where downside momentum abates), versus a price low (an old-fashioned good low).

So, a tedious retesting process still may be in the cards for the likes of CS DB, even USO, before true victory can be claimed by bulls.

I will flesh out those topics and plenty more for Members in my usual Midday Video.