18Feb10:50 amEST

Escape the Perceived Food Chain

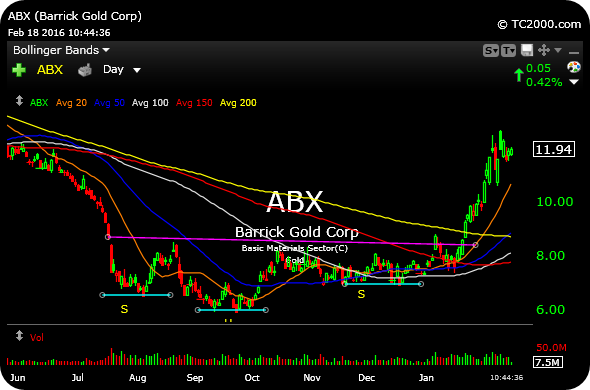

After a slew of earnings reports this week by precious metals miners, most are holding up fairly well. GFI gapped down over 13%, but the likes of ABX flipped red-to-green this morning, seen below on the daily chart flagging well over a confirmed inverse head and shoulders bottom.

In light of getting pounded to one new low after the next since 2011, it is of little surprise that the notion of a new bull market for the gold miners seems improbable. In fact, it is perhaps one of the most contrarian theses in the investment community, given how many mainstream fund managers have eschewed the miners as a laughingstock for so long.

As always, the market is the final arbiter and will dictate whether we have a new bull on our hands. To be sure, the metals themselves, gold and silver, have not given back much of their multi-week rallies into February. And if miners can continue to fight off the many faders and doubters here, I suspect another leg higher this winter may throw the majority for a loop as something beyond a trivial "fear trade."

Regarding equites as a whole, the market loos to be digesting the last few days of rallying, with GS and some banks notably lagging, as is NFLX.

On the upside, a few retail plays like COH and KORS have been impressive.