29Feb12:45 pmEST

The Market is Negotiating with China

Despite the Shanghai sell-off last evening, U.S. stocks are acting reasonably well today, even in the face of weakness in healthcare and biotechnology issues, too. Still, if that type of weakness cannot roll this market over below declining 200-day moving averages on the major indices, perhaps that is a signal to tread lightly with any short attempts for now, until bears show a bit more strength in the broad market.

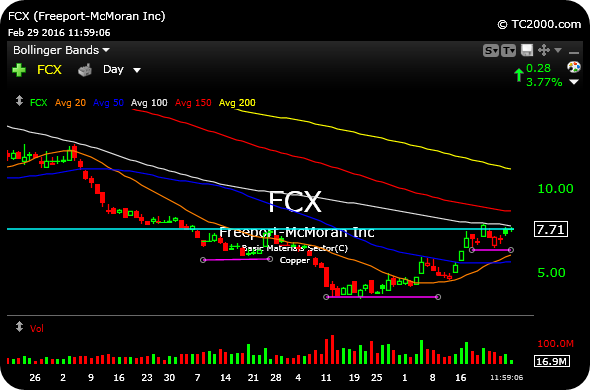

Regarding China, the FXI country ETF, below on the daily chart, may be working through an inverse head and shoulders bottom, outlined. Incidentally, major copper miner FCX is sporting a strikingly similar potential setup, too.

Hence, this week may prove to be a pivotal one for China, global materials miners, as well as other distressed parts of the market attempting to stabilize. I suspect, whether the bottoms confirm or are completely negated for a fresh leg lower, that China and copper will move in tandem, and that once we crossover into March tomorrow we should get a better idea of the outcome.

I will cove those topics and plenty more for Members in my usual Midday Video.

Healthcare Kabobs on a Skewe... High Stakes Game of Kiss and...