04Mar3:31 pmEST

There's Two or Three Potential All-Stars in There

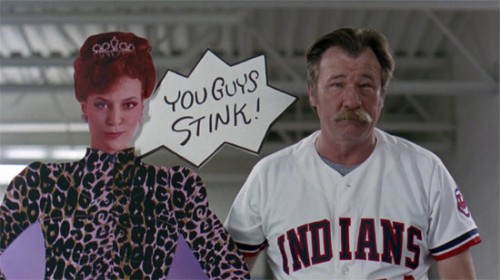

The global materials and mining complex has been on a tear of late. And, to paraphrase Lou Brown, there may very well be two or three potential All-Stars in there, in terms of new market leadership going forward. However, the complex is seeing some notable fades this afternoon, perhaps profit-taking and shaking and baking to keep the momentum latecomers honest. We sold into earlier strength in the mining complex and will see out reentries in the coming days and weeks.

I am not necessarily looking for a sharp correction in them. However, it is worth noting that commodities are notorious for taking their sweet old time to put in meaningful bottoms.

Hence, not throwing caution to the wind is important, since the sheer volatility and price swings in commodities and miners will likely convert some cowboys into being cautious next week. We always want to focus on finding low risk entries with well-defined stop-losses.

But circling back to the idea of commodities and materials potentially taking a while to bottom, note a scenario below on the SLX, steel sector ETF. That pattern amounts to a well-defined bottom. However, we do not go "off the races" in a new bull run until 2017--Again, just a Friday afternoon scenario, but one worth keeping in mind. Simply put, there is no substitute for discipline and patience.

More on this, and plenty more, for Members in my full video Strategy Session.

Have a great weekend!

Update on LinkedIn and What ... What to Look for at a Bear M...