14Mar3:08 pmEST

Update on Precious Metals and Miners

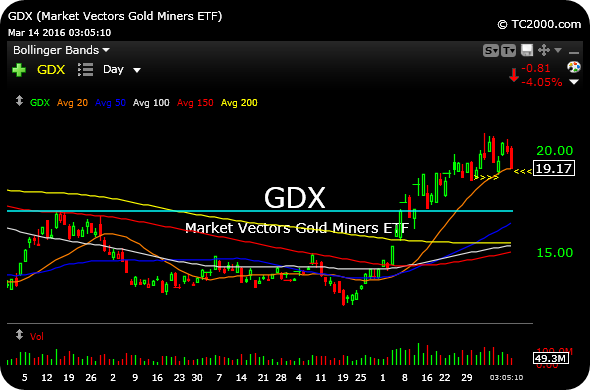

Although seeing GDX down 4% today may not be very pleasant for NUGT and JNUG holders, gold miners in general have given back very little of their winter rally off a potentially significant bear market bottom.

Trading around commodities, especially as they go about proving these potential bottom and the emergences of new uptrends, requires a certain willingness to either accept drawdowns like today if you are assuming the bottom is in place, or instead nimbly dip in and out of the complex until the bottoms have been confirmed more broadly. We have opted for the latter, with today being a good example of why assuming anything in the way of an inflection point in the high beta land of commodities carries far more risks than many would readily acknowledge.

Still, seeing the forest for the trees is important, so as not to let short-term volatility cloud out the juicy new potential bull run.

GDX still likely needs to hold over $17, in the event we see a post-FOMC sell-off in the metals and miners. In the very short-term, today marks the second 20-day moving average (orange line) test for GDX in two weeks. Whereas the first test was bought for a minor bounce to a lower high, I suspect this test may not fare as well before the Fed.

Ideally, the metals and miners will sell down some more into the FOMC and then commence a fresh leg higher into the spring months.

The GLD ETF, for gold itself, has a rising 200-day moving average now, enough to say with a straight face that gold bullion may already be in a new bull market. However, I still want to see silver (SLV) an especially GDX follow suit before adding more credence to that claim.