15Mar10:42 amEST

You Call This One and It's All Over, Baby

The price action in the stock for Valeant Pharmaceuticals this morning tends to bring out the gambler in many traders; Those who assume that just because the stock is down nearly 40%, it therefore follows that a tradable low is imminent.

To be sure, VRX will stage sharp reflex rallies from deeply oversold conditions, barring an outright collapse to zero. But whether that rally happens here or 20% lower is another matter to consider.

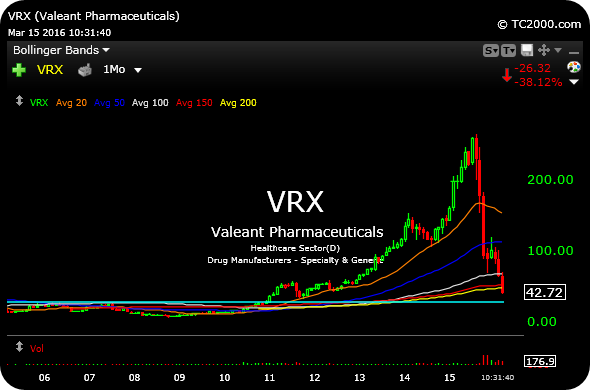

In prior instances of parabolic multi-year charts, such as DDD, the entire prior advance had been retraced before a more durable rally took hold. With respect to VRX, the monthly chart below illustrates the violence of downside momentum once the upside move finally cracked. You can see the fallacy in assuming that the stock must reasonably bounce and stabilize just because it had a rough autumn and winter.

In fact, downside momentum moves can often defy logic in their sheer ferociousness even more than the upside ones can with their resilience.

Therefore, it is within shot to see VRX tag the upper-$20s before buying calls makes sense. Note that bear trends, to paraphrase Jim Rogers, do not end on multi-year lows, they tend to end on multi-decade lows. So VRX may have a date with some prices from 2005/6 before a tradable low is in place.

Either way, the 'Three Day Rule" applies here--Letting the funds unwind into later this week makes sense, at a bare minimum, before trying to gamble it up with a high profile stock with high profile market players involved (cross-check HLF today, for reference).