23Mar12:51 pmEST

An Adventure Into the Fire

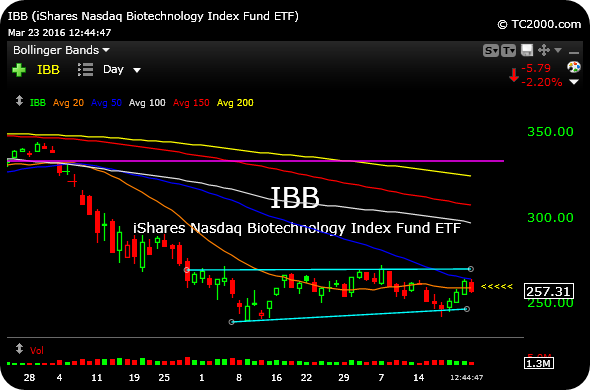

The rally in biotechnology shares in recent sessions has tempted many to look for a meaningful bottom, which may still be a possibility, after months on end of notably weak price action.

It is worth noting that IBB, the larger cap biotech sector ETF (below on the daily timeframe) still has yet to precisely test its 50-day moving average since January 4th, the first trading session of 2016. To go this long without testing the 50-day is a bit rare for a major sector, and perhaps drive home how weak biotech has truly been after a seemingly unstoppable run since 2012.

IBB came within pennies of testing the 50-day, currently at $264.23 and declining, the last two sessions, but just missed it.

Today, biotech is coming in on modest sell volume, which is surely something bulls will argue as a buyable dip. In all likelihood, it is probably best to see how biotech handles its 50-day into the end of quarter/end of month next week after the long holiday weekend coming up, as it dances into the fire.

Alternatively to the bull case, if this is as good as it gets for biotech in terms of a relief rally since February, then we know which part of the market should lead us lower throughout the spring months.

Large caps like BIIB REGN should provide clarity as to whether their current daily charts are proving true as potential double-bottoms.