13Apr10:52 amEST

You'll Need Backup to Trade This Stock

There is no shortage of drama or headlines when it comes to Valeant Pharmaceuticals International, Inc. over the last few quarters. This morning, for example, the CEO agreed to be deposed by a Senate committee, side-stepping a potential contempt citation. Bill Ackman is, of course, still a major player in the name and can cause ripples at any moment with actions or statements he makes.

Beyond that, the day-to-day movement of the stock has been akin to a goldfish flopping around outside of its tank.

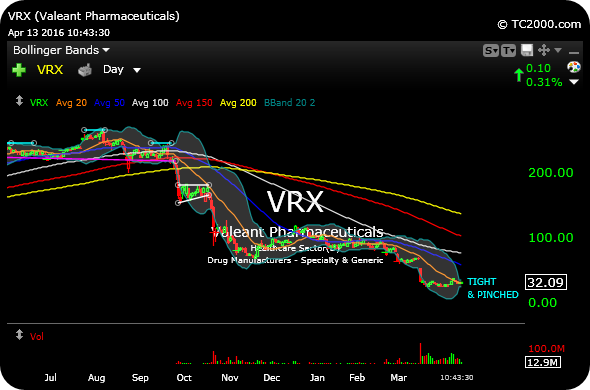

But all of the back-and-forth has amounted to price essentially operating in a fairly compact space in recent weeks. The net result has been, as we can see on the VRX daily chart, below, that the Bollinger Bands are now extremely "pinched," indicative of price compression.

From periods of compression often come directional explosions. And with earnings still a few weeks away in May, the stock may finally be ripe to make its next true move after what has been a powerful downtrend since its confirmed head and shoulders top in September 2015.

For longs, the 20-day moving average, below, at $30 or so, makes sense as a logical stop-loss, while bears will want to cover over $33 and especially $35.

One thing is for sure: You will want to keep a close eye on this one at all times if you trade it.

Stock Market Recap 04/12/16 ... Local Anesthesia for Regiona...