22Apr12:47 pmEST

Don't Try to Change That Number

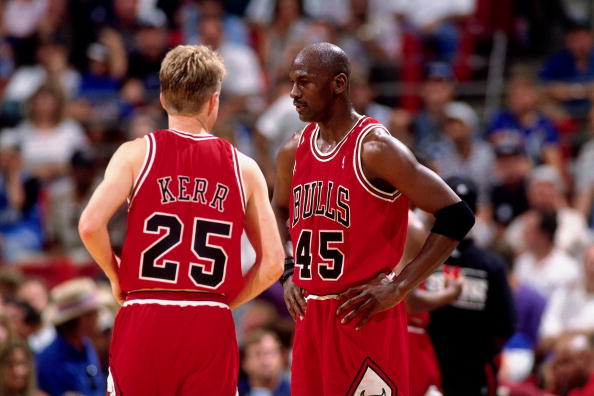

Taking a lesson from when Michael Jordan switched to number 45 after coming back from his baseball stint, lost to the Orlando Magic in the 1995 NBA playoffs, then came back the next year as number 23 again and won the NBA Championship with arguably the most dominant team in the last two decades, we should not change our number when it comes to gold miners.

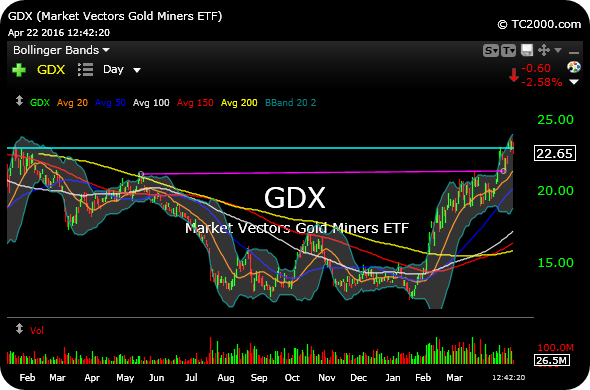

Specifically, the $21.50 level on the GDX (ETF for senior gold miners) worked well for longs in recent weeks.

We sold our miners in recent sessions, but if $21.50 now holds on pullbacks into next week a long trade is certainly back on tap for gold and silver miners, among other materials miners.

To the upside, holding over $23 has been a sticking point for gold bugs go late, punishing Johnny-Come-Lately momentum longs who thought buying JNUG was an easy score.

In reality, trading virtually all commodities and commodity-related instruments, including individual miners, amounts to "adult swim" trading and should never be taken lightly.

To be sure, very agile shorts may make some headway into next week, as the likes of NEM give back gains from yesterday here.

But given the overall price and volume surges across the board since January, I am much more focused on fresh entires on the long side for swings than I am attempting to play a prospective pullback in the precious miners.

The Microsoft Clippers Take ... Saturday Night at Market Che...