02May3:36 pmEST

Don't Trap Yourself

Without question, the precious metals miners have trapped a good amount of shorts since mid-January, when an apparent breakdown to fresh bear market lows suddenly reversed higher and, basically, did not so much as look back in the rearview mirror to see if the predator-turned-prey DUST/JDST holders still had a pulse.

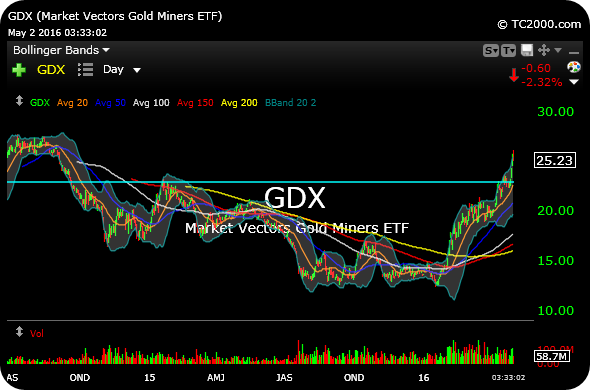

Seeing as it is now May, some several months later, some consolidation in the miners makes sense. We noted over the weekend for Members that GDX (senior gold miner ETF) finally tagged in 200-period weekly moving average for the first time since 2012. So, again, some backing and filling is perfectly logical here, albeit with the typical and expected commodity gut-wrenching volatility.

Moroever, note how the miners are trading lower today despite a weak U.S. Dollar, when they *should* be rallying. This type of dynamic may add credence to the notion that fresh money longs do not necessarily have a favorable risk/reward ratio up here in miners, at least not for the next few days or even weeks.

In terms of levels to hold, we still want to see $23, below on the GDX daily chart, convert into support after acting as prior well-defined resistance.

Precious metals and their derivative miners may still very well be in the early innings of a new bull market. But that ought not to be a crutch for longs, especially those unaccustomed to the violent swings for which commodities are notorious.

Not Quite the Memorial Day M... Stock Market Recap 05/02/16 ...