03May10:48 amEST

Chase the Chasers

We have some nasty whipsaws taking place across several markets this week, with equites gapping, in many case, free and clear below the apparent bull victory seen during yesterday's rally.

Goldman Sachs, a premier financial firm, is a good example of the above, sporting strength yesterday to the delight of bulls only to give up the ghost, and then some, this morning. Biotechnology issues also fit that description.

AAPL and CMG are showing some curious relative strength there. But we know they have been so badly beaten-down that it may just be a case of sellers being short-term exhausted there before another push down sometime soon.

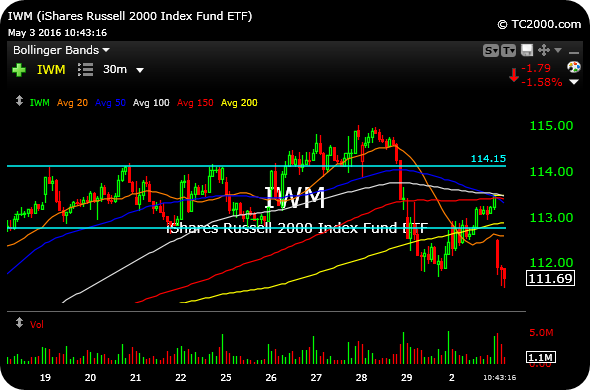

Overall, the small caps used up a ton of buying power yesterday to get back inside the range seen in our ongoing look at the zoomed-out IWM 30-minute timeframe.

Below, an updated chart of the Russell 2000 Index's ETF illustrates this concept, with the move yesterday back in the range giving way to a harsh gap down this morning. Typically, this is a bearish development and should be taken seriously, despite the resilience of the tape since February.

$113 was our level below for bulls to hold, and thus far this morning they have failed miserably at defending it.

Also note the violent and abrupt giveback in the miners this morning, driving home the need to continue to be disciplined and nimble in that complex even if they have put in good bear market lows.

Stock Market Recap 05/02/16 ... Pay Your Dues Before Summer ...