16May12:58 pmEST

Making Sense of the Dancing Around

In recent sessions we have seemingly alternated between individual "trend days" being up or down, which likely reinforces the notion that the market remains at a critical juncture from a long-term technical perspective.

Bulls are convinced The Fed is on the correct path, there is no recession coming, and that sentiment is simply inconsistent with a looming decline in equities, while bears point to narrow leadership, with many former leaders like DIS NKE SBUX now showing weakness, as well as a general topping out look and feel to plenty of long-term charts.

And thus we have the day-to-day indecision play out in a rather pronounced manner.

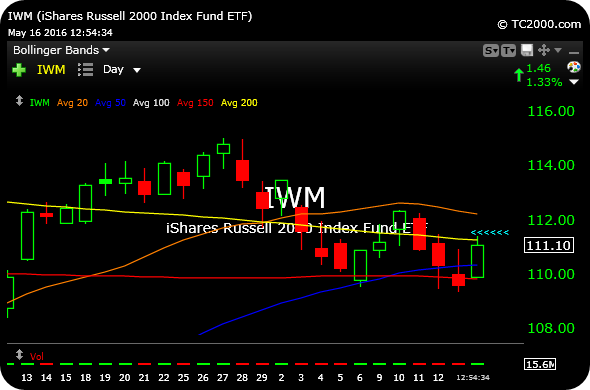

Regarding the action into the afternoon, keep an eye on the small cap ETF, below on the daily, as it deals with its declining 200-day moving average overhead. We rallied up to it in a virtual straight-line this morning only to back off, but bulls are giving it a go again as I write this.

Beyond the AAPL/Buffett bounce, markets are also rallying in front of HD and LOW earnings this week, two dominant firms which could be ultimately help resolve the ongoing debate in the market when they report tomorrow and Wednesday, respectively.