18May1:00 pmEST

Minutemen Strategic Positioning

In front of the Fed Minutes coming out after 2pm EST today, from the last FOMC meeting, some interesting positioning is taking shape.

Financials continue to snap back hard, while Treasuries are seeing their heaviest day of selling in a good while. Banks have been laggards, on and off, with prominent firms like GS and WFC suspiciously weak.

However, the betting pattern today is such that market players seem to be positioning for a hawkish tone to the Minutes, what with banks up along with rates.

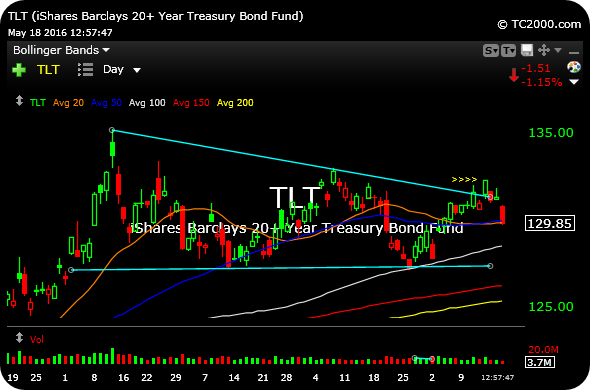

Regarding TLT, essentially the ETF for Treasuries (inverses to yields), note how the $132 level above continues to act as resistance. Moves above that level have been faded, even with an apparently bullish-looking triangle (light blue) in place.

Should the Fed Minutes fail to take on the type of hawkish tenor the market now expects, I would be looking for banks to offer a short entry.

Of course, there is always the possibility that "someone knows something," and hence this positioning, which is why I am currently flat and waiting for a better setup after the Minutes.