23May1:12 pmEST

Will Starbucks and the Consumer Fend off Diabetes?

It is fitting, in light of the controversy Starbucks had to quash earlier this year, that the sugar rush SBUX and indeed many marquee consumer names have enjoyed going back many years is still under scrutiny by the market.

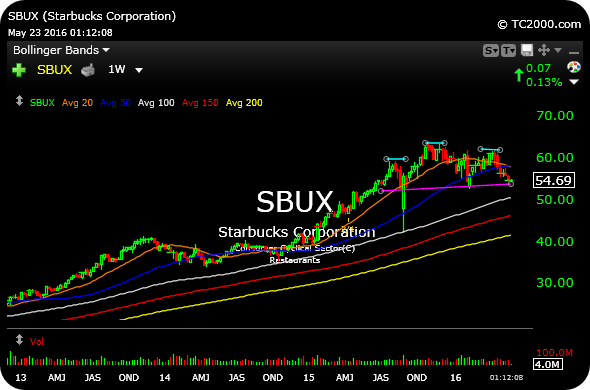

Beyond that, SBUX and the likes of DIS NKE UA, among others, have shown discernible cracks in their respective foundations and may be on the verge of topping out. Indeed, the weekly chart for SBUX below illustrates a potential and juice head and shoulders top after its own multi-year sugar run.

But the counter-argument by bulls is becoming increasingly valid now and ought to concern bears into the summer months: The market is now simply giving longs too much time to exit their positions and raise cash. And we know that market history teaches us that bear market are rarely so accommodating in that regard--Usually a topping process is followed-up with a decisive break which then, in turn, comes nowhere close to prior highs for a good while.

That may still happen, but bears are going to need that reckoning sooner than later, to punish bulls for a runaway sugar high in lieu of letting them off the hook for more goodies to pair with their mocha. Psychologically, historically, even technically, markets rarely give bulls this much time to "sell the top."

The Miners Have This Rat: Th... Saturday Night at Market Che...