08Jun1:16 pmEST

Guilty or Not Guilty

To be sure, the small caps and indeed many stocks flying under-the-radar have thrived in recent weeks, as bears are largely on the run and likely extremely fearful of seemingly inevitable new highs on the major averages this summer.

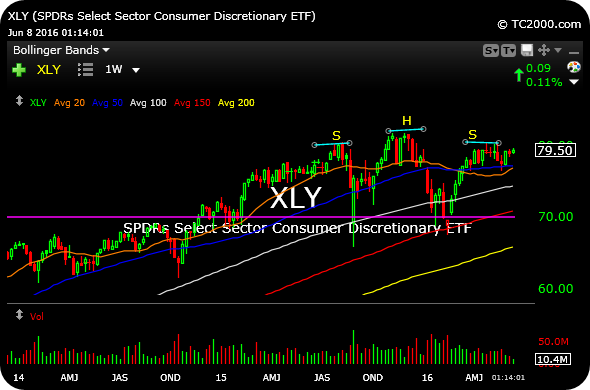

However, a peculiar aspect about this rally has been the underperformance by many notable consume leaders, most of which are housed in the XLY ETF for discretionary firms. To drive a point home we have emphasized for Members previously, we cannot cherry-pick the weakness in the likes of DIS GM NKE SBUX, etc., as being evidence per se of an imminent bear market.

But to zoom out for a bit from the current rally, the guilty or not guilty verdict from the jury regarding the potential head and shoulders top, outlined on the XLY, below, has yet to be rendered. That $79-$80 area, indeed, continues to be a heckuva battleground by all accounts.

And as we move throughout the summer months, the bull or bear argument ought to once and for all be decided here insofar as the top actually confirming or instead being smashed to smithereens as bulls march higher and the performance chance gathers steam into the back half of 2016.

If Team Cocoa Gets Going, It... Better Call Paul, Season Two