13Jun3:34 pmEST

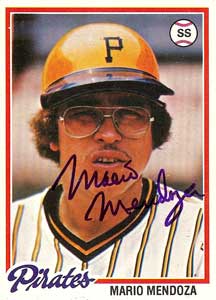

Back Above the Mendoza Line

The CBOE Market Volatility Index, or VIX, which is considered to measure fear according to the options market, is shooting higher today after flashing signs of life last week for the first time in a good while.

Back over 20, the VIX is crossing over the "Mendoza Line," so to speak, where it begins to take on some significance of typically a corrective market in equities.

Of course, we have some major events coming up this week with the Fed and the Brexit vote next week. So, the potential for the market simply scrambling to price in the perceived event risks is certainly one explanation.

But the real test should come as to whether the VIX can effectively hold over 20 now, and build on the notion of a stocks correcting further.

For now, this type of action seems to be keeping a lid on even the most enticing long setups in stocks, while other stocks of the weaker variety are sliding further.