14Jun10:29 amEST

Do One Thing with the Rumor, Do Another with the News

Before the Fed Meeting Announcement tomorrow afternoon, and then the Brexit vote next week, it is interesting to see various markets aggressively price in certain outcomes.

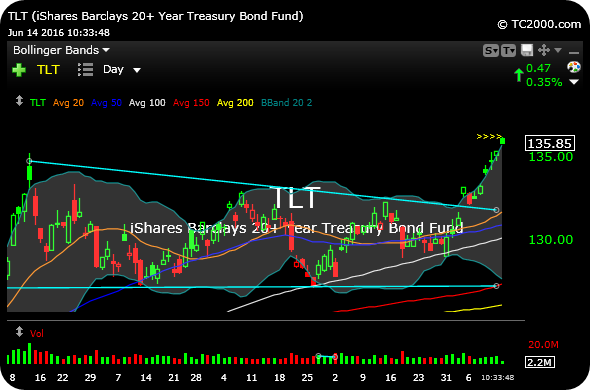

Specifically, banks and Treasuries seems to be pricing in no rate hike by the Fed and rather dovish language to boot, with the XLF (financial sector ETF) falling hard over the last week while TLT (ETF for Treasuries) is continuing to stretch out even after it became overbought. The BAC daily chart, then the TLT daily, first and second below respectively, illustrate this point.

Moreover, the VIX seems to be aggressively pricing in event risk, at a minimum. And, of course, there is always the ominous possibility the VIX could "know something" bad is coming, with room to move higher yet.

We covered a GS short this morning for Members, however, because this could easily be a "sell the rumor, buy the news" setup for banks, and vice versa for Treasuries, assuming The Fed is indeed dovish.

And if they come out hawkish, buckle up.