16Jun10:56 amEST

Changes In Latitudes, Changes In Attitudes

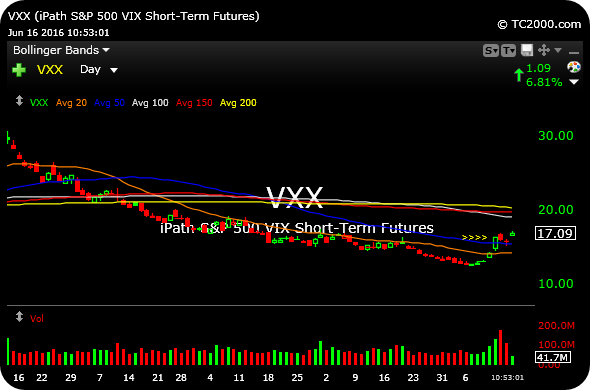

It may seem quaint, but a casual look at the VXX (ETF for the VIX, or Volatility Index) illustrates subtle change in attitude from what had been a very subdued level of fear in the market in recent months.

Note the two-day pullback into the Fed was bought, as the VIX is holding above 20 now for the first time since February. This higher low in the VIX and its derivative ETFs is likely enough to keep new equity longs on hold for now.

On the short side, we are seeing some of those big consumer winners in the XLY ETF staying weak here.

My main focus for Members will be updating the very best of those ideas in real-time, especially as we approach the key 2045 battleground level on the S&P 500 Index, an area bulls have previously defended in a valiant manner.

But with the VIX showing signs of waking up even more, it would be wise to no assume support will hold automatically this time.