05Jul1:05 pmEST

It Doesn't Matter Until it Does

Of all the inter-market concerns being called out today pertaining the equities, such as the strength in gold and Treasuries, perhaps the most glaring issue is the Japanese Yen.

For several months during the late-winter and spring period, equities largely ignored strength in the traditionally risk-averse/safe haven Japanese Yen currency. And just as we see with most stereotypical correlations/inverse correlations, they can often detach for extended period of time since nothing on Wall Street is ever a sure thing 100% of the time.

Hence, shorting this market based solely on the Yen strength earlier this year would have been a painful proposition for traders without immediate stop-loss and position sizing discipline.

But just as with most things in life, just because something is not working right now does not mean it will not work in the future. So the Yen strength fell into the category of, "it does not matter to stocks until it does," meaning if the Yen strength persisted it would more likely than not eventually get to stocks.

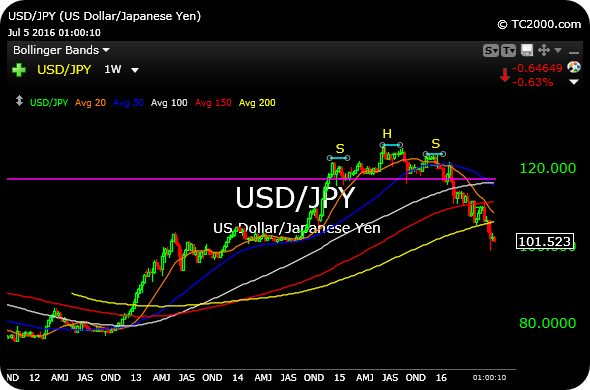

Updating the Dollar/Yen cross, below on the weekly timeframe, note that the Yen is the denominator. As this chart moves lower, the safe haven Yen implicitly moves higher, a concern for stocks.

After a multi-year bull run since 2011/2012, the cross topped out with the confirmed and highlighted head and shoulders pattern.

The lack of a clear bounce of late remains a lingering concern. And if today's weakness in stocks builds on itself, I suspect it will start to matter much more than it has in recent months, for the Yen remains in an uptrend throughout 2016.

I will cover updated ideas for Members now in my usual Midday Video.

Not Quite the Memorial Day M... Stock Market Recap 05/02/16 ...