20Jul12:58 pmEST

Let's Keep Track of the Count

As equities keep grinding higher, it is worth keeping track of the precious and non-precious miners.

After all, miners have staged brilliant rally since the beginning of this year and could still easily be in the early innings of a new bull market, in their own right.

Today is the second day of miners, by and large, finally seeing some more aggressive profit-taking as the U.S. Dollar rallies. One thing to note is how quickly sentiment flips bearish here, which would be the hallmark of a new bull run and, ultimately, a buyable dip. Thus far, I am seeing some signs that is playing out, with long-term conviction in miners still very much in doubt.

We want to see recent gold bulls quickly abandon their thesis into this pullback, which ought to provide some type of "sentiment put" beneath the likes of GDX SLX and XME, eventually setting up a new leg higher.

We also may very well grind it out until Labor Day before that happens, in terms of a meaningful new leg higher, but that is part of the roadmap I will be discussing with Members in my Midday Video, coming up.

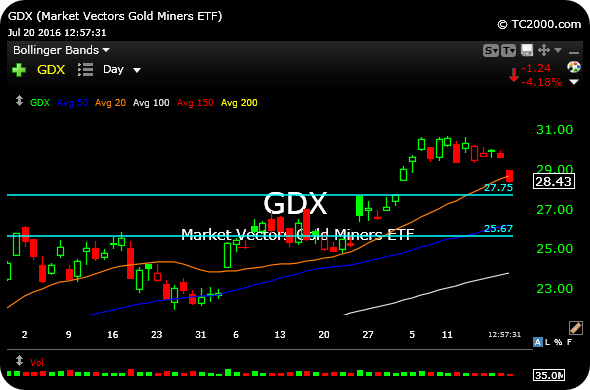

Regarding some specific levels, on the GDX (senior gold miner ETF) daily chart, below, note the first open gap below is at $27.75, followed by $25.67. There is no guarantee we will fill those gaps, of course.

But even long-term gold bugs should be rooting for at least one of those to get filled, to clean out any short-term excesses from the latest segment of the rally which began in June.

Similar comments apply to the steels, as well as the likes of CLF SWC TCK.

The Elder Statesman of the S... Let's ANIP This Issue in the...