22Jul10:45 amEST

I Know Why the Caged Bear Cries

One of the interesting and recurring aspects about the rise in equites in recent years has been the consistent manner in which buyers have eschewed fear of the many typically concerning divergences across a variety of markets.

Whether it be the transports, retail, biotech, energy weakness, or the Yen strength, just to name a few, bulls have cemented their legacy in this market as being as resilient as any bunch in the history of Wall Street.

On that note, the recent inability of crude oil bulls to hold bounce should also, typically, be concerning.

But the indices are essentially yawning it off on this summer Friday morning, once again compelling traders to not be so rigid in their approach to correlation and potential warning signs.

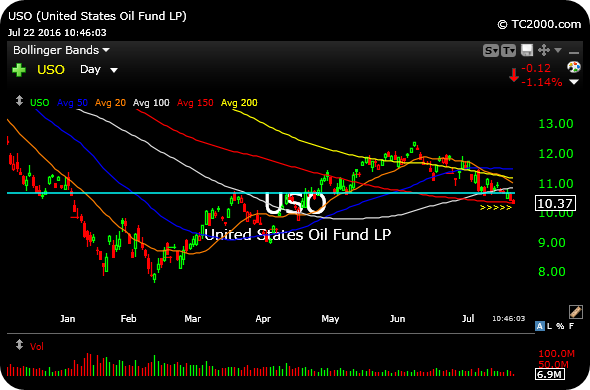

Still, on a standalone basis there can be little argument that USO (ETF for crude, below on the daily timeframe) is weakening below its prior $10.80 breakout area (light blue line). Most energy stocks, however, are not particularly spooked at all, and same with emerging markets.

Thus, this type of market compels us to simply take each chart on a standalone basis, meaning just because oil itself may be a short we are going to need to see actual evidence of a correlation coming to fruition with equities and risk assets as a whole before sounds the alarms with the S&P still right at all-time highs.