27Jul12:32 pmEST

Dead Ahead of The Fed

After the AAPL and TWTR fireworks carried over this morning from last evening's earnings report, the market is largely asleep in front of the 2pm EST FOMC Announcement. Beyond that, we have plenty more significant earnings reports this week, with FB tonight and AMZN GOOGL tomorrow, among others.

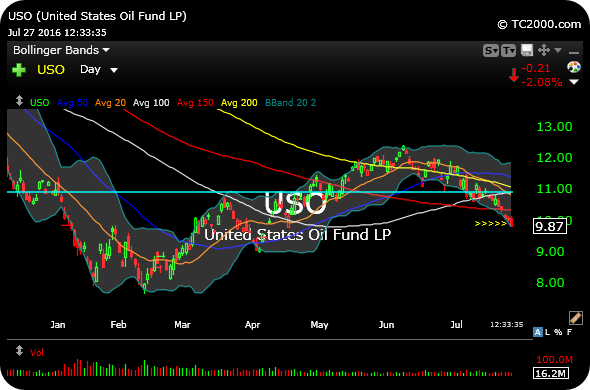

The inability of crude oil to hold a bounce remains a concern, as the commodity has essentially been in a steep downtrend since early-June.

On the updated USO daily chart, below, the ETF for crude illustrates the lack of buying power even as crude is short-term overload at the lower Bollinger Band, after this morning inventory report. Even emerging markets and energy stocks in the EEM, XLE, and OIH ETFs, respectively, which have remained largely unperturbed by oil's weakness are now acting at least a little concerned.

Then again, as I noted for Members earlier, the FOMC can essentially act like an earnings reports for commodities, fixed income, and currencies, which means we need to stay on our toes this afternoon and the rest of the week for some abrupt moves despite the sleepy summer feel to the price action of the market at the moment.