10Aug1:15 pmEST

Exxon, X Off

Much like tobacco firms, Exxon Mobil is used to being seen as the villain in global capitalism.

Recently, XOM has been a bastion of safety in a very volatile energy complex, as the elder statesmen in the large cap, integrated space served as a store of value, on the whole, while MLPs were liquidated and smaller/mid-cap energy firms were fortunate to try to even stabilize.

By and large, XOM is enjoying a terrific 2016.

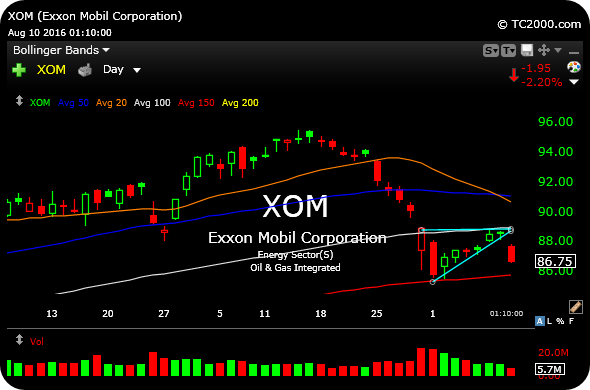

However, since mid-July, when the S&P 500 began to mark time sideways, Exxon has been a notable laggard. On the updated daily chart, below, note the decisive bear flag breakdown in progress today, pending the closing bell.

On the one hand, this can be seen by energy bears as portending ominous signs in energy as a group. After all, if XOM led us up, then of course it will lead us lower.

However, energy bulls will counter than capital is simply rotating out of the safety of XOM and into some of the more higher beta, riskier, debt-ridden groups within energy.

And therein lies the setup in the energy complex into Labor Day and beyond.

At the moment, crude is staying fairly weak after a post-inventory fade, as are most energy stocks. But, regardless of which argument prevails, the safety of the large cap integrated plays appears to be unwinding into the tail end of summer.