17Aug3:34 pmEST

Fed Member Earl of Sandwich was Indecisive on a Rate Hike

After the Fed Minutes today stocks are bouncing back, with the SPY over $218 now into the final moments of the day.

It is still tough to become too bearish on this tape until we see sellers hold down some of these moves. While momentum to the upside has been skittish since Monday, on the whole, there are some hidden gems perking up we are looking at for Members.

As for Treasuries, they bounced a bit on the Minutes but are far from convinced of a full-on dovish scenario.

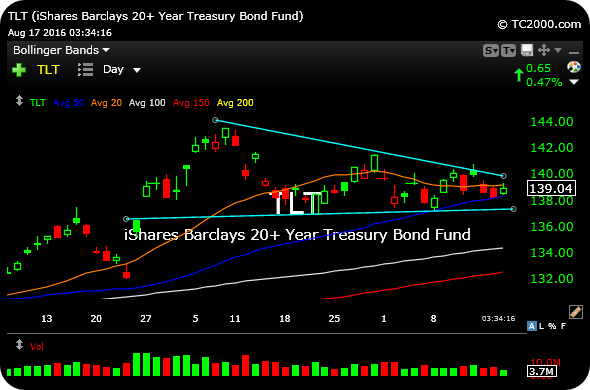

On the TLT daily chart, below, note how the ETF for Treasuries is effectively pinned in between its 20 and 50-day moving averages for a moving average "sandwich."

Whichever way this breaks should give us insight into the next trade for utilities and REITs.

Taking Gold Miners One Step ... Stock Market Recap 08/17/16 ...