17Aug10:49 amEST

Regional Banks Forming Their Own Super PACW

Given the selling we have seen in the utilities and REITs of late, the yield-chasers may be scrambling for the exits, finally. The reason for such an exit would be a hawkish tone by the Fed, once again.

The Fed has bluffed quite a few times of late and may be prepared to bluff at higher rates, once again. But the selling in the IYR and especially XLU has been a bit more meaningful than anything we have seen in a few months. Indeed, the FOMC Minutes later today should shed at last some light on just how hawkish the Fed is prepared to be into the autumn months, along with Jackson Hole next week.

A beneficiary of higher rates still figures to be the regional banking sector. The KRE, sector ETF, is outperforming the XLF today, not to mention the market as a whole. I am looking to see if that holds beyond the Minutes later on.

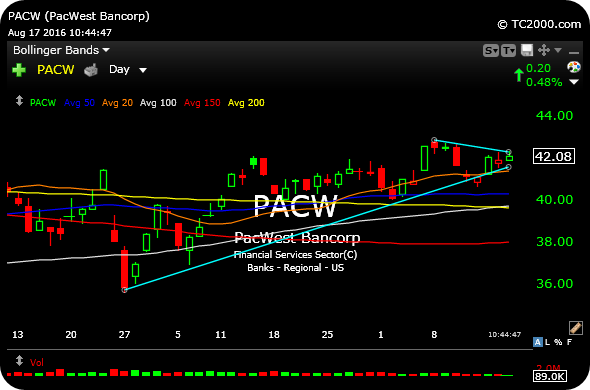

PacWest Bancorp is a long idea we are keeping on watch now, with a move back over its morning highs of $42.34 likely to bring in further buying.

On the daily chart, below, PACW is back above all moving averages and looks to be threatening a triangle breakout.

Stock Market Recap 08/16/16 ... Taking Gold Miners One Step ...