01Nov10:45 amEST

You Bust the Joint Out; Ya Light a Match

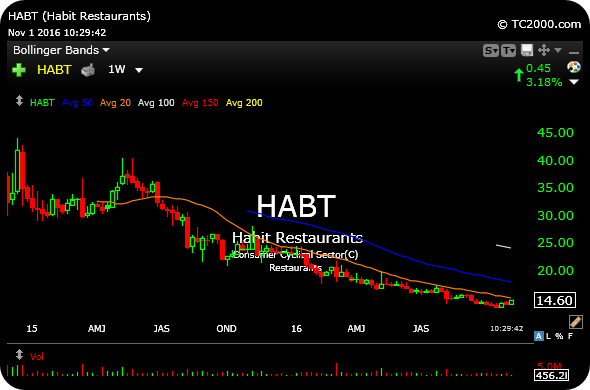

It sure has seemed like burger joints HABT and SHAK have been partially run by Big Pauly, what with their seemingly endless destruction of capital for the last 18-24 months at odds with creating shareholder value.

Their respective weekly charts, below, illustrate as much. Simply put, the market has declared HABT and SHAK to be clear losers in what was already a mixed casual dining space.

Both firms report earnings within the next two weeks, raising the issue of perhaps whether they are now so bad, they may actually be good for a trade into the holidays. If there were ever going to be a reprieve from these potent downtrends, then it makes sense to see it headed towards Thanksgiving and Christmas.

What is attractive about these charts, from a contrarian perspective, is how steep their downtrends truly are. And it thus follow that if they are not going to zero anytime soon, a counter-trend rally could easily see gains of 20-50%, possibly even 100% in a fairly short-period of time.

First things first, though, getting through earnings and assessing the aftermath. Beyond that, this thesis assumes at least a somewhat stable broad market. Otherwise, I will gladly take a pass. But with the carnage these names have sustained for a good while, it is worth a gander.

Elsewhere, stocks are red overall with yet another green open faded. Small caps remain wobbly even as biotechs try to hold green. Volatility is creeping up in front of the FOMC tomorrow, keeping bulls on their heels and me staying defensive.

Stock Market Recap 10/31/16 ... Energy Has Been Building for...