03Nov1:31 pmEST

Back Above the Mendoza Line as Baseball Season Ends

We last looked at the "Mendoza Line" on the VIX back in June before BREXIT.

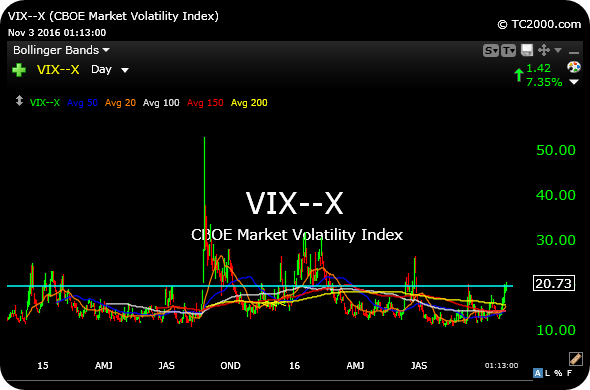

Specifically, The CBOE Market Volatility Index, or VIX, which is considered to measure fear according to the options market, is shooting higher today after flashing signs of life last week for the first time in a good while. Back over 20, the VIX is crossing over the "Mendoza Line," so to speak, where it begins to take on some significance of typically a corrective market in equities.

Of course, we have some major events coming up with more earnings, the jobs number tomorrow, and the General Election next week. So, the potential for the market simply scrambling to price in the perceived event risks is certainly one explanation.

But the real test should come as to whether the VIX can effectively hold over 20 now, and build on the notion of stocks correcting further.

Indeed, it is one thing to spike above 20 on the VIX, but holding over it would likely indicate a deeper correction in stocks than many currently think is on the horizon. Still, it is not worth using the VIX at the heart of your market analysis, but rather as another piece of the puzzle. The true test is going to be the price action in leading and many individual stocks, which currently still suggests a market at least in need of a reset, if not further correcting.

More in my usual Midday Video for Members.

Swimming the Channel This Su... Excuse Me, I Believe You Hav...