07Nov12:59 pmEST

Come and Get Me, Copper

Now that plenty of market players and pundits alike have trivialized, if not mocked, the lack of correlation between copper and risk appetite for a while now, it would be very typical of markets, indeed, for copper to now suddenly begin to take on global significance to markets, again.

Either way, on its own merits copper has been basing sideways over the last year amid a plethora of calls for its ultimate demise. Still, copper has been hanging tough and even began moving up sharply in recent weeks, dismissed by copper bears as a routine short squeeze.

But what if it is something more than that?

If inflation truly is in its early stages, then so too, in all liklehlood, would a new and shocking bull run in the industrial metal.

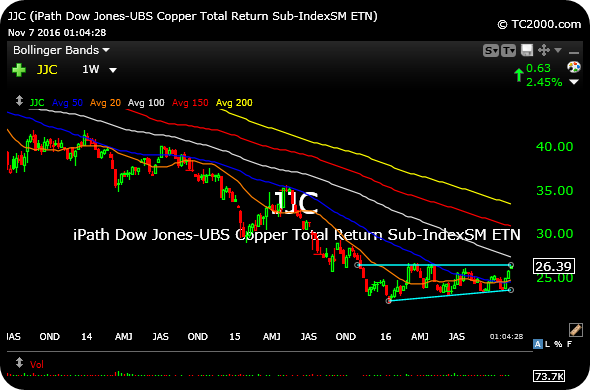

On the JJC weekly chart, below, ETN for copper, the metal has been basing since last November. Note the upside resistance line now in danger of being breached, which would unleash something much more potent than a mere squeeze.

With this in mind, a copper miner like FCX becomes even more viable on the long side. Against the backdrop of a contrarian inflation thesis, copper and FCX are quickly become attractive long on a going forward basis for something more than a quick scalp.

More on this and the broad market in my usual Midday Video for Members.

Fall Back, Spring Ahead Into... Running on a Specific Platfo...