10Nov10:12 amEST

Taxation Without Carbonation!

In addition to the sudden headwind of higher rates and an unwinding of the "yield-seeking safety trade," one of our Members noted the major soft drink beverage firms are also looking at a flurry of Soda Taxes passed around America on Election Day.

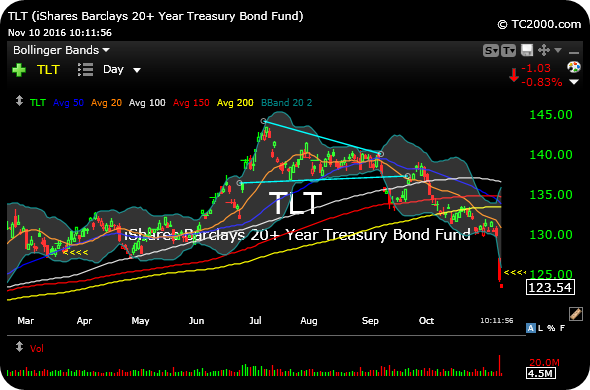

Several weeks back, we noted that the daily charts for TLT (Treasuries) and XLP (consumer staples ETF) were tracking very closely. In other words, as rates went higher, both TLT (as expected) and XLP went lower. This remains the case today, and is even more magnified as the early stages of inflation seem to be clearly in play.

As an example, copper and copper miners are displaying all of the hallmarks of a major inflection point after a prior, multi-year bear market followed by about a year of being "dead money" sideways. Copper and its miners are now acting like they are in a new bull market, ignoring overbought conditions amid surging buy volume breakouts.

Trading inversely to higher rates, however, are the staples. And the soft drink kings like KO and PEP are in a very tough spot all the way around. I have been short KO inside Market Chess Subscription Services, and plan to hold for a longer duration than most trades if this specific thesis continues to play out.