14Nov10:47 amEST

Let's See Which Bears Defy Gravity

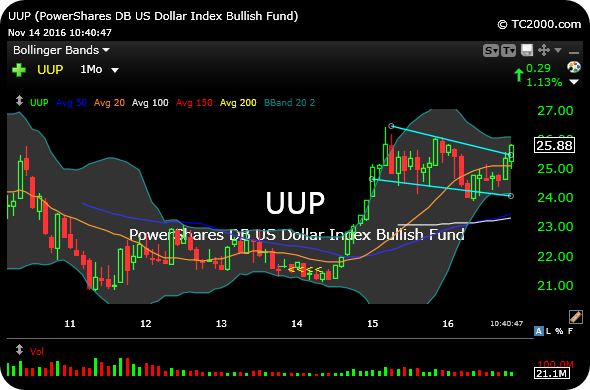

Seeing as the UUP, ETF for the U.S. Dollar currency versus a basket of major global currencies, is surging today on massive buy volume, it is worth revisiting the long-term chart for perspective.

On the monthly UUP timeframe, below, note the distinct possibility now of a meaningful upside breakout for the greenback. Combined with Treasuries continuing to sell-off as rates rise, this type of dynamic has the effect of a de facto tightening, pushing The Fed into a bit more of a dilemma as we head into the December FOMC. Simply put, if The Fed fails to raise rates in December and TLT keeps selling off while UUP rises, there may be some dislocations headed into 2017.

First things first, though. My main concern this morning is discerning which commodities are best holding up in the face of the Dollar strength. Clearly, gold, crude oil, and silver are not taking kindly to the Dollar, whereas copper and natural gas are shrugging it off. Coal stocks continue to act very well, as are steel names.

Normally, one would expect coal to get sold aggressively with the Dollar up and crude down. However, the Trump victory is likely helping. But also note coal was slaughtered for years on end, and sellers may just be exhausted in general.

Either way, Dollar strength of this magnitude usually provides an excellent litmus test was to which commodities can distinguish themselves and defy gravity.

Special Edition: Full-Length... Trouble for the Married-to-a...