17Jan10:44 amEST

Not Quite Ready to Leave Port

We have a fairly busy shortened week of trading underway, with plenty of earnings and macro events. A big bank like Morgan Stanley reversed down pretty hard after earnings, off by nearly 3% as I write this. Netflix earnings tomorrow, as well as GS in the morning, are sure to capture plenty of attention, too.

But the U.S. Dollar price action should not be overlooked, either. Commodities are mostly higher as the Dollar gets whacked, with President-Elect Trump even trying to talk down the greenback over the long weekend.

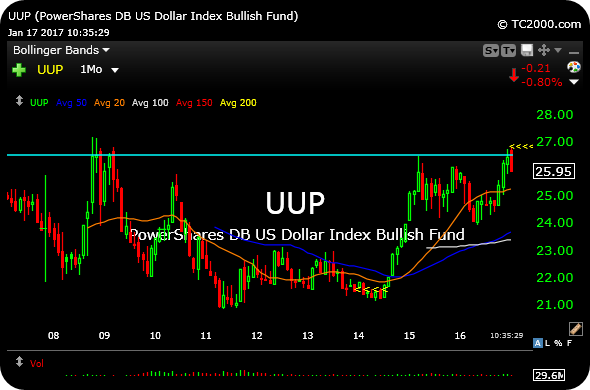

Commodities, especially the precious miners, now have a fine opportunity to regain the momentum they enjoyed in the first half of 2016. On the UUP (ETF for the Dollar versus a basket of developed economies' currencies) monthly chart, below, it is not all Trump and macro, per se, which is causing the selling.

As you can see, the Dollar is up against resistance dating back to the severe deflation of 2008, even the correction in the first quarter of 2015. A pause or pullback is expected here, as per the concept of "overhead supply," or likely resistance from prior trapped longs.

The true test will ensure for Dollar bulls soon, in terms of whether a long-term breakout is in progress and, if so, which commodities can hold up and even outperform.

Weekend Overview and Analysi... Doing God's Work By Building...