25Jan1:46 pmEST

Most Roads Lead to Inflation

Between the rally in most commodities, especially the premier global materials, a resurgence in regional banks favoring higher rates, a weakening Dollar, and most of all Treasuries unable to hold a bounce on Monday, it sure seems that the inflation argument is gathering steam.

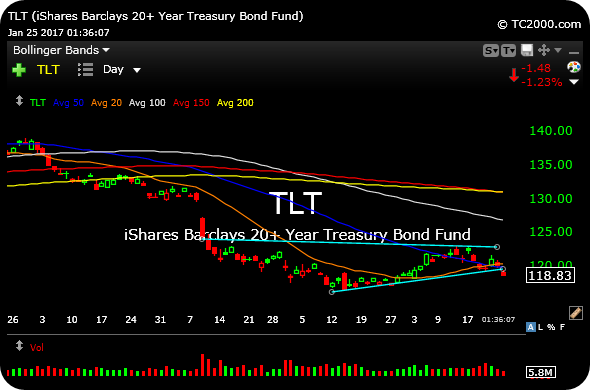

While bond bulls seem to have formed several factions, all leading to a sharp rally in TLT, the technical action this week have proven lackluster for that thesis. I took myself out of a bond short on Monday, only to see TLT give up the ghost, especially today.

One "tell" of the failed TLT rally may be the persistent weakness in rate-sensitive utilities, like DUK ED, over the last week. Even today, REITs are notably soft as large IYR holding, SPG, threatens a breakdown. But even with FCX (copper miner) and steels selling off, plenty other inflation/stagflation trades remain firm.

On a standalone basis, which matters most for the given market you are trading, Treasuries are on the cusp of a new leg lower which seems to have frozen bond bulls who expected a relief rally by now. I expect to see some inflation-esque setups both on the long and short side become even more pronounced if TLT fails to reverse here.