01Feb10:48 amEST

Life, Liberty, and the Pursuit of Diabetes

Regardless of where you fall on the political spectrum and, specifically, Starbucks CEO Howard Schulz's pledge to hire 10,000 refugees, the chart of the firm is clearly taking a turn for the worse after recent earnings.

A less political and more common sense explanation may simply be one of brand maturity and stretched price points, where consumers are become less and less infatuated with the culture of a Starbucks and are not so enthralled by the adventure of overpaying for a diabetes-inducing-sugar-bomb-disguised-as-coffee beverage.

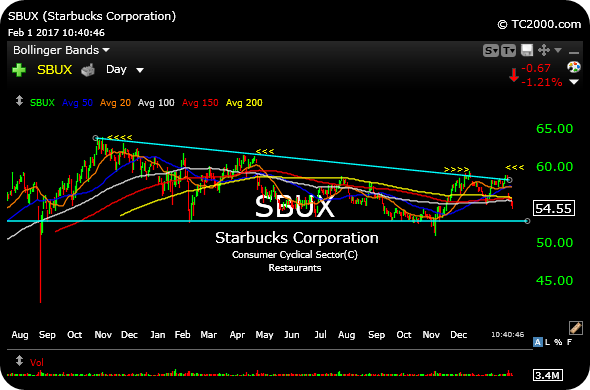

Turning to the chart, below on a zoomed-out daily timeframe, note how the long-running consolidation failed to resolve higher for bulls--The recent earning sell-off sent price back into the massive triangle.

And now bears have another chance to break SBUX lower to unravel what has been a monstrous rally since 2009. Moreover, the name is now trading below a declining 200-day moving average. another sign of caution.

So while AAPL bulls breath a sigh of relief this morning as that name is far from dead, SBUX bulls are a bit jittery as the prospect of another food or beverage brand which may have reached a tipping point, like CMG did last year. And if you think that comparison is too much, take a look at some innovative brands which are new and superior to SBUX, such as Bulletproof Coffee, among many others.