10Feb10:34 amEST

NVIDIA: Pronounce the "N" But Don't Look Down

At the risk of being overly-dramatic, the rest of today's trading session is shaping up to a rather significant portion of trading for NVDA's weekly chart.

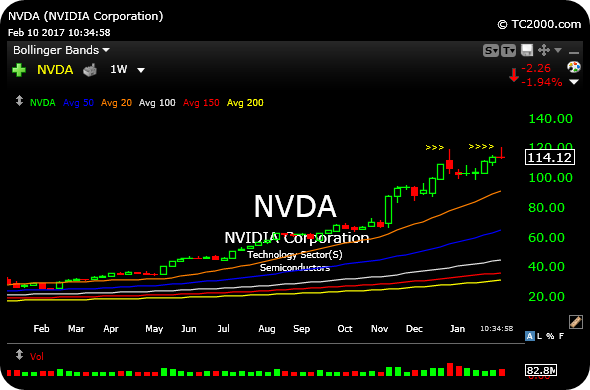

For a while now, the dynamic chip firm NVIDIA has been as hot as any reasonably-sized stock in the market. The essence of a strong uptrend can plainly be seen on that updated weekly chart, below.

But as this week closes out today at 4pm EST, NVDA will have formed its latest weekly candlestick. And the risk is that buyers are showing some notable signs of fatigue at the $120 level.

As we noted with energy stocks earlier this week, no single candlestick alone can confirm a reversal, up or down (in the case of energy stocks, the issue was whether they were reversing back up, which they have been thus far). But with respect to NVDA, other chips have been weakening, notably the likes of INTC QCOM TXN.

Therefore, if NVDA does begin to correct, let alone put in any type of meaningful inflection point versus the tough $120 level after prior steep uptrend, it could easily pressure the chips as a sector in the near-term.

Calling a top to NVDA has been futile for a good while now, and I am not about to probe a short, favoring recent shorts in QCOM INTC instead. However, if the dominant name in the semis closes here or lower into the weekend, it builds some more evidence that capital is flowing away from chips in February, possibly heading down to energy, retail, and other value plays.