28Feb10:49 amEST

Silver Linings in the Playbook for the Target Miss

Target is being properly punished by the market this morning with a rather ugly gap down after weak earnings and guidance.

On the surface, this type of action may seem to reinforce the bear case that brick-and-mortar, or non-Amazon, retail is largely dead. And while that may be true on some level, it cannot be true on every level.

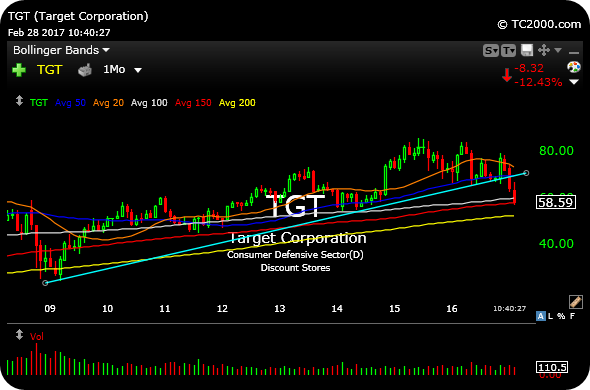

First, regarding TGT, the multi-year look below shows us the name was losing its major support trendline dating back to the 2009 lows even before earning. This latest gap down cements the idea that TGT is best left to the vultures, if at all, as there are plenty of better charts out there right now with which to contend.

But while TGT is struggling, the silver lining may be found in the knee-jerk selling to some other retail plays today. Foot Locker, for example, a name we looked at last Friday, is taking a break today. Indeed, the sympathy selling in other retail plays following the TGT disaster may provide some opportunities on the long side as this week unfolds.

You can be sure we will be tracking the better charts for Members in the retail space, some of which may continue to be overlooked given the negative connotation the retail sector carries these days.

Stock Market Recap 02/27/17 ... Two Charts for Good Perspect...