16May10:49 amEST

Money Finding a New Home

The notion that emerging markets are set to outperform most developed markets into the back half of 2017 is quickly becoming a rather sexy thesis, embraced by quite a few market players and pundits.

With the gaps higher in China internet plays this morning after assorted earnings, namely SINA and WB ahead of BABA on Thursday, that emerging market rotation thesis seems even more enticing.

We know Russia has had issues with weak oil and geopolitical headlines. However, if oil can muster a relief rally behind a day or two and nothing too ominous materializes on the news front even Russia should get a bounce.

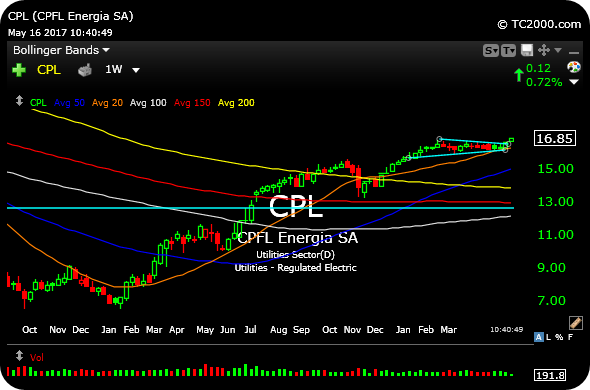

But the true stalwarts have been India and now Brazil and China are beginning to play catch-up. Regarding Brazil, the utility CPL, below on the first weekly chart, is as crisp and clean as it gets. Note price breaking a long, tight consolidation higher. On a relative basis, a utility in Brazil is a safer alternative than mixing it up with too much high beta, commodity-related plays.

As for India, VDTH (second daily chart, below) sports thin volume but is an intriguing bullish setup in an uptrend. The subscriber-based TV service ought to enjoy growth as India does, as a whole.

The emerging market rotation thesis seems like flavor of the month for May. I am looking to see if these moves have staying power over the summer and if more stocks participate from the BRIC countries. However, these two ideas are good examples of what we want to see.

Stock Market Recap 05/15/17 ... Let Them Drink Asparagus Wat...