02Jun10:56 amEST

Defeating an Obvious Narrative

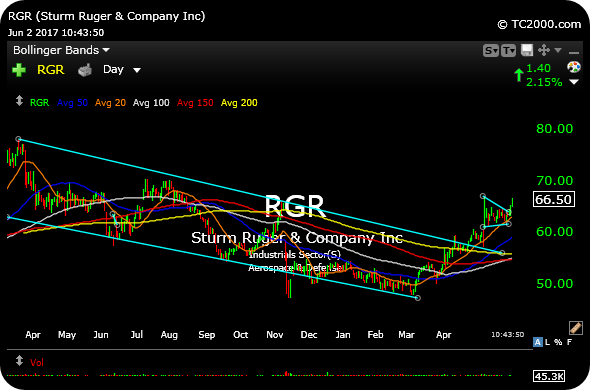

The election of Republican Donald Trump as a vocal proponent of the Second Amendment last November seemed to dampen the mood for the firearms plays, namely RGR and AOBC (formerly Smith & Wesson).

It seems obvious that RGR and SWHC (AOBC now) had thrived during the Obama years. However, a careful examination of both charts reveals they did indeed suffer rather steep corrections, even then.

So regardless of where you fall on the political spectrum, if anywhere, it is intriguing to say the least that both AOBC and RGR are breaking out to multi-quarter highs on their respective daily charts, below, after badly lagging the market since November. Indeed, it may now merely be a function of the bull market lifting most boats.

But what makes this development all the more enticing on the long side is how many naysayers there are as far as the bull case for these two stocks--The reflexive counterpoint is that there is now too much inventory and there was too much prior demand used up during the Obama years in the mad scramble to buy up all the guns.

So what if that narrative is not quite sound? RGR has the more appealing long-term technical bull case at the moment. But, really, if the market is aware of some viable bull theses for both names then it has a good cover under the darkness of the conventional narrative discussed above.

Stock Market Recap 06/01/17 ... Housing: Time to Let Bygones...