12Jun10:28 amEST

Exxon, Risk Off

A fairly obvious rotation out of technology/discretionary leaders, such as AAPL AMZN FB GOOGL, among others, is materializing this morning on the back of the same theme to close out last week.

While the Nasdaq is at least undergoing a shakeout, if not more, what seems to be keeping things afloat on many levels is the lifeblood of a bull market: Rotation.

Specifically, energy, banks, small caps, builders, among some other parts of the market are seeking to benefit from tech's outflows, at least in the near-term as we zoom towards the FOMC later this week which is rue to have some type of impact across several asset classes.

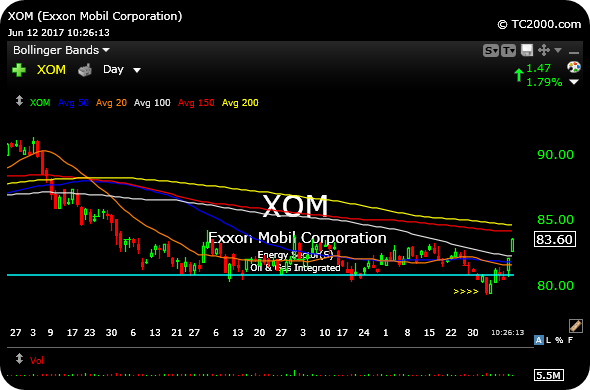

With respect to energy, market cap heavyweight XOM, below on the daily chart, may very well hold a key to the rotation thesis even if only as a symbolic chart. Note how price threatened a fresh breakdown on Friday, June 2nd (arrows), only to reverse back higher above breached support.

This morning, Exxon is rallying up and off that support, which seems to be indicative of a false breakdown from two weeks ago. As it is often said in technical analysis, from false moves in one direction often come aggressive moves in the other.

But given XOM's $360 billion market cap and its obvious impact on the XLE ETF, it is hard not to pay close attention to Exxon even if it is not a particularly fast mover for traders. If XOM can now hold back over the low-$80s and gather steam for a move higher off this morning's strength, it ought to bode well for energy as a whole to sustain a rotation for more than just a day or two in an "Exxon, risk off" market.